does texas have an inheritance tax 2019

Final federal and state income tax returns. There is no inheritance tax in Texas.

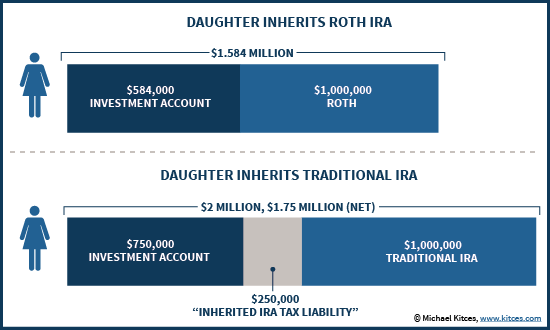

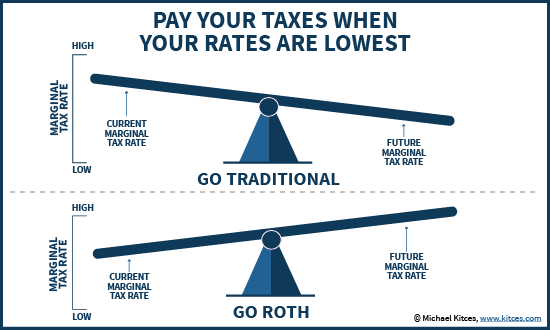

When It S A Bad Deal To Inherit A Roth Ira

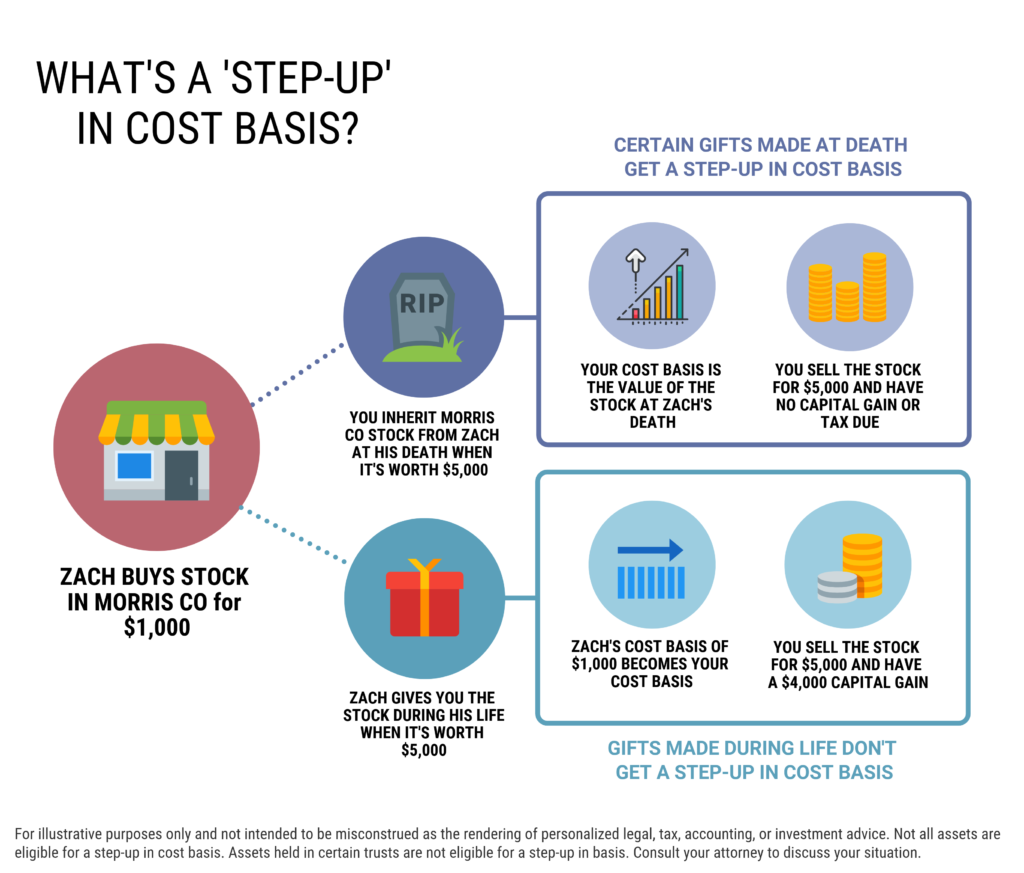

1 A capital gains tax is a tax on the proceeds that come from the sale of property you may have received.

. The tax did not increase the total amount of estate tax paid upon death. T he short answer to the question is no. The state of Texas is not one of these states.

As of 2019 only twelve states collect an inheritance tax. While most states in the United States have an inheritance tax Texas doesnt. October 16 2019.

Higher rates are found in locations that lack a property tax. Someone will likely have to file some taxes on your behalf after your death though including the following. However localities can levy sales taxes which can reach 75.

In addition to the federal estate tax of 40 percent some states levy an additional estate or inheritance tax. However other states inheritance taxes may apply to you if a loved one who lives in those states gives you money so make sure to check that states laws. However a Texan resident who inherits a property from a state that does have such tax will still be responsible for paying the relevant tax due.

These states have an inheritance tax. As of 2021 the six states that charge an inheritance tax. For instance theyll have to pay the final federal and state income taxes and any federal estate income taxes as well as any federal estate taxes.

Washington States 20 percent rate is the highest estate. Alaska is one of five states with no state sales tax. Texas does not have an inheritance tax meaning no death-related taxes are ever owed to the state of Texas.

This is because the amount is taxed on the individuals final tax return. Twelve states and the District of Columbia impose estate taxes and six impose inheritance taxes. If you have a loved one who dies in Pennsylvania and leaves you money you may owe taxes to.

The Inheritance tax in Texas. Some beneficiaries will have to pay some taxes on behalf of the generous dead person. Inheritance tax rates differ by the state.

For example in Pennsylvania there is a tax that applies to out-of-state inheritors. You may have to pay federal estate taxes but not state inheritance taxes. Some states have inheritance tax some have estate tax some have both some have none at all.

Texas has no inheritance tax so any money you receive as a beneficiary is not charged state tax income tax property tax or capital gains tax. Iowa Kentucky Nebraska New Jersey Maryland and Pennsylvania. Some states have inheritance tax some have estate tax some have both some have none at all.

The state of Texas does not have any inheritance of estate taxes. There is a 40 percent federal tax however on. On the one hand Texas does not have an inheritance tax.

There is also no inheritance tax in Texas. As of 2019 only twelve states collect an inheritance tax. Therefore if you inherit possessions property to sell or keep or money from a loved one in Texas you most likely wont need to pay any tax.

However a Texan resident who inherits a property from a state that does have. The good news is that Texas doesnt impose an estate or inheritance tax. See where your state shows up on the board.

There is also no inheritance tax in Texas. Rather a portion of the federal estate tax equal to the allowable state death tax credit on the federal estate tax. Right now there are 6 states that have an inheritance tax.

The Executor must file a federal estate tax return within 9 months and pay 40 percent of any assets over that threshold. As of 2019 if a person who dies leaves behind an estate that exceeds 114 million. The state of Texas does not have an inheritance tax.

Even though no state inheritance taxes are imposed some estates are subject to federal estate taxes. Maryland is the only state to impose both. Before 1995 Texas collected a separate inheritance tax called a pick-up tax.

March 1 2011 by Rania Combs. Understanding how Texas estate tax laws apply to your particular situation is critical. Texas is one of a handful of.

However if a loved one gifts you something elsewhere in the country you may need to pay that states inheritance tax. Finding Information About Taxes On Interest An initial gift of money or property is tax-free but if. Texas does not have an inheritance tax meaning no death-related taxes are ever owed to the state of Texas.

Federal estatetrust income tax.

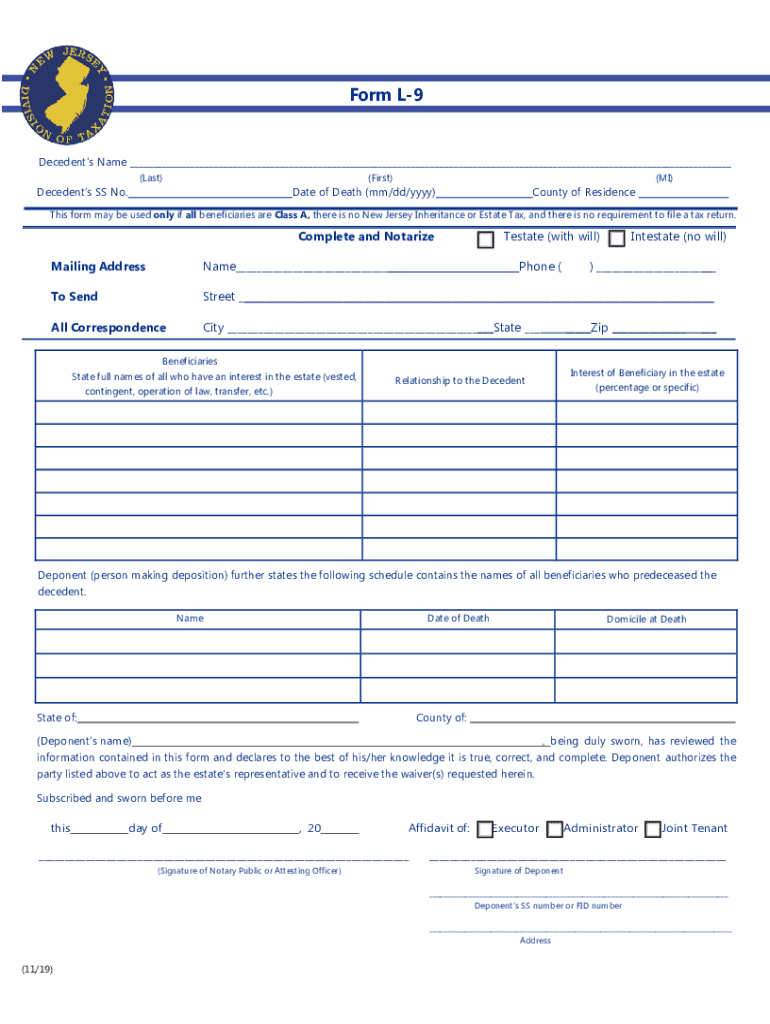

Nj Dot L 9 2019 2022 Fill Out Tax Template Online Us Legal Forms

Are Texas And Taxes Pronounced The Same Quora

What Is The Standard Deduction Tax Policy Center

Are Texas And Taxes Pronounced The Same Quora

Texas Estate Tax Everything You Need To Know Massingill Attorneys Counselors At Law

Are Texas And Taxes Pronounced The Same Quora

Is There An Inheritance Tax In Nc An In Depth Inheritance Q A

When It S A Bad Deal To Inherit A Roth Ira

What Is The Standard Deduction Tax Policy Center

How Do State And Local Individual Income Taxes Work Tax Policy Center

25 6 1 Statute Of Limitations Processes And Procedures Internal Revenue Service

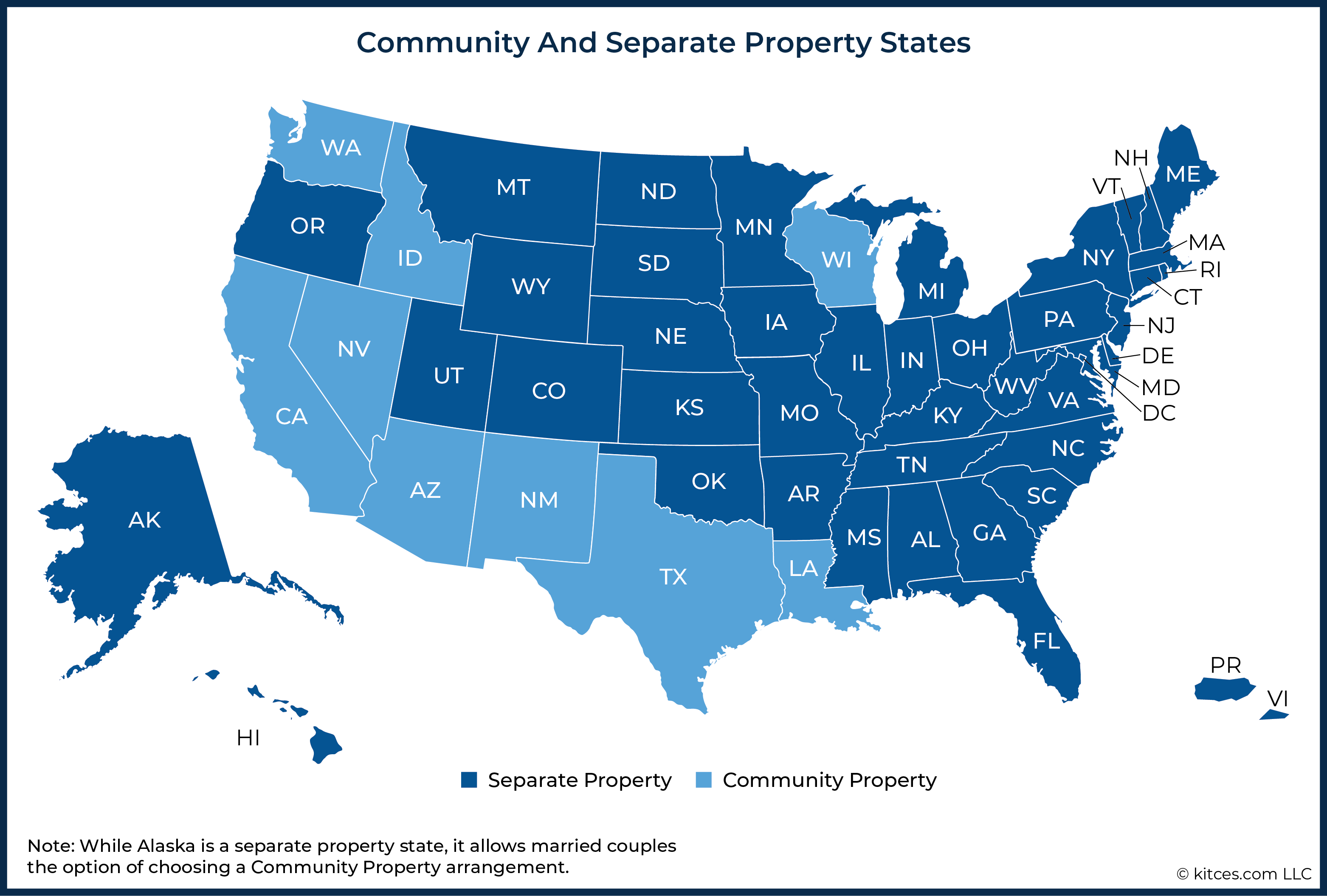

Using Gifting Between Spouses To Maximize Step Up In Basis

Asset Protection Planning Albin Oldner Law Pllc

California Inheritance Tax Inheritance Tax In California Lawyer Legalmatch

Are Texas And Taxes Pronounced The Same Quora

25 6 1 Statute Of Limitations Processes And Procedures Internal Revenue Service